Jim Stack:

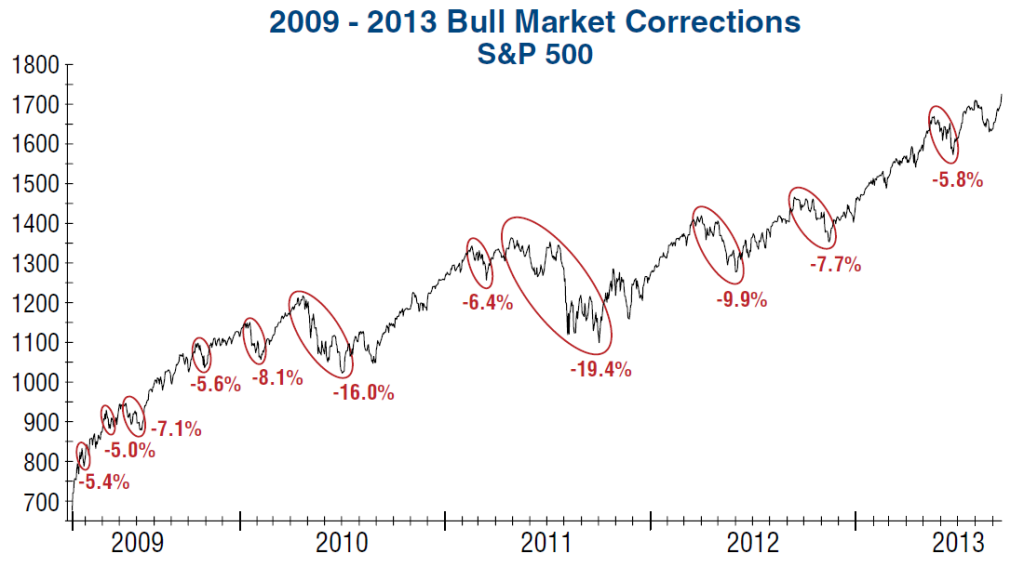

“Historically, the average time between market corrections is 7.6 months. However, as shown in the graph [above], there were five corrections in just the first year of this bull market. After the initial 12 months, corrections slowed and followed a more typical pattern, occurring once or twice a year. Altogether, there have been 11 corrections of 5% or more, with two of those logging greater than 10% declines.How does this compare to other extended bull markets? At 4.5 years, this bull market is already one of the longest since the Great Depression. Looking at the S&P 500 back to 1932, the average bull market duration is 3.8 years and, in comparison, this one is getting a little long in the tooth. Still, it does have a few peers… of the 16 bull markets over the past eight decades, only five prior to this one lasted more than 4.5 years.”

Source: TBP

No comments:

Post a Comment